vermont sales tax on alcohol

Alcoholic beverages sold by holders of a First or Third Class Liquor License are subject to the 10 Vermont Alcoholic Beverage Tax. Catering Service Billed as a Package Like a.

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes

Vermonts excise tax on Spirits is ranked 15 out of the 50 states.

. Local option tax is calculated as 1 of the taxable net sales for each town. A transaction is subject to local option tax if it is subject to the Vermont sales meals rooms or. Review the Guide to Meals and Rooms Tax and Sales and Use Tax Statistical Data for detailed information how the spreadsheets are formatted and how to read the data.

The tax applies to alcohol that is suitable for human consumption and contains one-half of 1 percent or more of alcohol by volume. 15th highest liquor tax. IN-111 Vermont Income Tax Return.

PA-1 Special Power of Attorney. Malt beverages and spirituous liquors are subject to a. Alcoholic Beverage Sales Tax.

Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities. O Includes sales from State liquor agents to bars and restaurants. Alcoholic beverages subject to meals and rooms tax are exempt from sales and use tax.

Vermonts sin taxes cover alcohol and cigarettes. For those who sell beer cider RTD spirits beverages or wine to stores or restaurants. The tax on alcohol depends on the type and alcohol content of the beverage.

Constitution repealed the Volstead Act Prohibition. For beverages sold by. Are groceries taxed in Vermont.

Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA. In Vermont wine vendors are responsible for paying a state excise tax of 055 per. For those who supply spirits to the Vermont Division of Liquor Control.

Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that are suitable for human consumption and contain one-half of 1 or. Higher sales tax than 88 of Vermont localities -88817841970013E-16 lower than the maximum sales tax in VT The 7 sales tax rate in Manchester consists of 6 Vermont state. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants.

Control of the sale. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states.

Vermont Wine Tax - 055 gallon Vermonts general sales tax of 6 also applies to the purchase of wine. 2022 Vermont Sales Tax Changes Over the past year there have been four local sales tax rate changes in Vermont. Combined with the state sales tax the highest sales tax rate in Vermont is 7 in the cities of Burlington Essex Junction Rutland South Burlington and Colchester and 39 other cities.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. W-4VT Employees Withholding Allowance Certificate. This table lists each changed tax jurisdiction the amount of the change.

See our website at taxvermontgov for information related to the necessary forms and for due dates. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from.

Whistlepig 15 Year Old Straight Rye Whiskey Finished In Vermont Oak 750 Ml Bottle

Property Tax Forecast Projects 6 Percent Increase Vermont Business Magazine

Scott Pulls Russian Alcohol From Vermont Shelves Vtdigger

Beer Map How High Are Beer Taxes In Your State State Beer Map

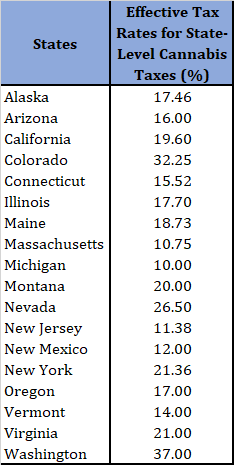

Assessing State Level Adult Use Cannabis Taxation Aaf

Wine Taxes How High Are Wine Taxes In Your State Wine Tax

Vermont Cigarette And Tobacco Taxes For 2022

General Sales Taxes And Gross Receipts Taxes Urban Institute

Vermont Income Tax Calculator Smartasset

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Caledonia Spirits Barr Hill Gin 750 Ml Bottle

Alcohol Taxes On Beer Wine Spirits Federal State

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Last Call Beer Institute Blasts Reduced Rtd Taxes In Vermont Ippolito Christon Warns Of Convenience Terminations Brewbound

Vermont Income Tax Vt State Tax Calculator Community Tax

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

Vermont Legislature Expands Market For Ready To Drink Spirits Beverages Food Drink Features Seven Days Vermont S Independent Voice

Beverage Warehouse Vermont S Largest Craft Beer Wine Liquor Store